No Free Gas

Introduction

Targon Community: now that we are three months into dTAO, we believe it is important to begin sharing more regular updates. These updates are meant to give you a better idea of where we are today, but more importantly, where we are heading tomorrow. As always, we are ruthlessly focused on the long-term sustainability of the Bittensor network. We believe this is the most important issue of our time.

At its core, Bittensor is a marketplace of digital commodities. These commodities are powering the AI revolution, and properly incentivizing their production is of vital importance. In our view, compute is the most important commodity of the AI revolution, no different from the importance of electricity during the Second Industrial Revolution. Today’s compute owners are highly capital inefficient (see Lambda Labs’ $500M debt facility, rumored 15% interest rate), and we believe Targon can play an important role in reducing many of the inefficiencies that exist today. By allocating capital more efficiently, the world will have more compute and therefore more AI abundance.

A Billion Dollars of Responsibility

Every day, 7,200 TAO tokens are printed. At a price of $400, this is a significant amount of money - $2.8M a day, $87.6M a month, $1B a year. For any enterprise in the world, a $1B investment would merit significant returns. We feel an immense responsibility to use emissions in the most efficient way possible.

If we opened a gas station and cut our prices to $0, we would expect a line of cars that stretched further than the eye could see. Would this be a good way to gain loyal customers? Not in our view. We would expect these customers to quickly leave us as soon as we raised our prices in line with peers. This is what happens in commodity markets, and we do not expect compute to behave any differently over the long run. Therefore, printing TAO tokens to perform free inference on other companies’ models is not overly interesting to us. It is important from a load testing perspective, but Targon does not plan on using our sacred emissions in this way. Instead, we are focused on building enterprise-grade solutions for companies looking to adopt AI.

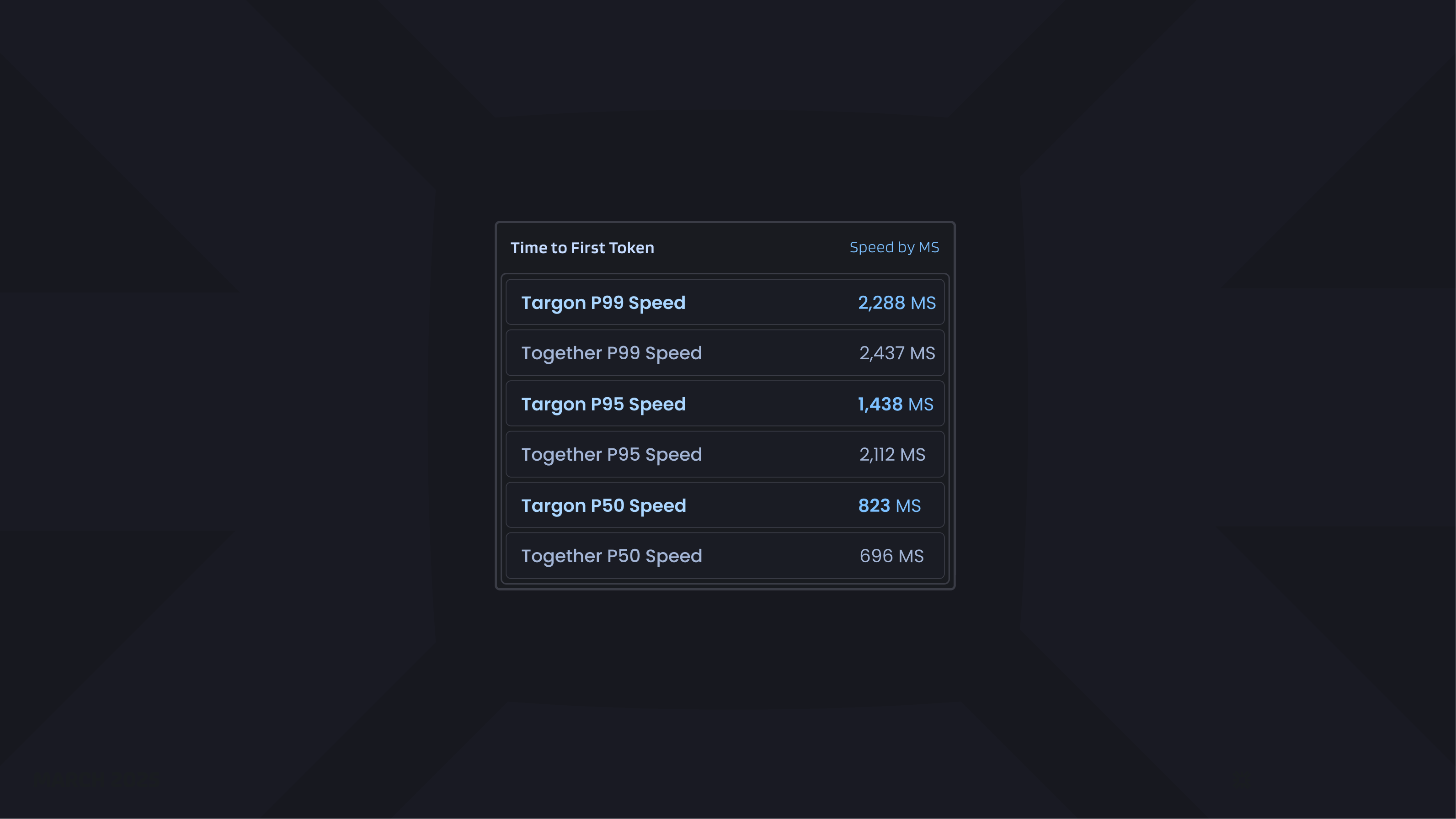

Dippy is a great example. Dippy is an AI companion application where users can interact with a number of characters. Their product has gained increasing traction and currently handles over 10B organic tokens a day. We are working closely with their team to build a solution that outperforms Together AI. Dippy has been moving an increasing percentage of their traffic from Together to Targon, and we are pleased to report that yesterday we saw the following metrics:

We are looking to add 2-3 additional superstar engineers to the Targon team to build our own proprietary inference engine, along with other features (i.e., storage) that will allow us to continue taking business from Together. If you are currently using Together, please reach out and we will build you a custom solution.

Transitioning from the Individual to the Institutional Miner

There is a problem today in Bittensor, where many compute miners do not actually own their hardware. This is important for several reasons: 1.) miners who rent are much more sensitive to fluctuations in price or emission; 2.) these miners are short-term in nature and are simply performing arbitrage at the expense of those who hold TAO. Historically on OpenRouter, firms like Nebius are winning in two ways. If Nebius receives an organic request, they generate inference revenue. If Targon receives an organic request, one of our miners serves this request with compute they are renting from Nebius. This seems like a great deal for Nebius, and a bad one for TAO holders.

To solve this, we have been working to familiarize compute owners with Targon. Earlier this week, a mid-sized compute owner flew down to Austin to meet us at our office. We discussed creating an efficient compute market and the importance of transitioning from the individual miner to the institutional miner - similar to Bitcoin’s shift beginning in 2013. By bringing hardware owners onto Targon, we can bring down the cost of compute, and we can make our market sustainable without relying solely on TAO inflation. Today, every dollar that a miner receives is funded by $1 in speculation. We are working to create a market where every $1 that a miner receives is funded by $1 in organic revenue generated on top of the compute provided.

You are likely thinking: how exactly will Targon drive down the cost of compute? In our view, today’s compute prices are artificially high due to burdensome financing costs. These elevated interest rates get passed directly to the consumer. We believe rates are higher than they should be because there is significant counterparty risk when lending to a single institution (i.e., Lambda Labs) - the lender is betting that Lambda will monetize the compute efficiently enough to pay the interest rate. If users on Targon can monetize compute better than any single institution, then compute owners will naturally gravitate toward the network offering the best return on their hardware. As the Targon return profile matures, we anticipate lenders will offer cheaper financing rates to owners who provide on Targon. From there, the flywheel takes off.

Efficient Emission Allocation

Today, we are burning 70% of the emission on Targon in order to ensure TAO holders are not paying above market rates for compute. As of writing, miners are earning ~$2.80 / hr for providing an H200. It then becomes our duty to earn greater than $2.80 per hour in organic revenue. By doing so, we can reinvest back into subnet 4, delivering a healthy yield to our compute providers. As more compute comes online, we will begin burning less of our emission in order to maintain the $2.80 payout. But we want to be careful not to oversaturate Targon with more compute than the economy can afford. This will eat into miner profits, significantly harming their ability to provide compute. Volatile payouts do not work for owners with regular interest payments. We must meet compute owners where they are, and build a solution that suits their reality.

If we spend millions to provide free inference with no clear path to sustainable revenue, we will have done nothing but make the Bittensor collective poorer. We are ruthlessly focused on monetizing our compute as efficiently as possible. In the near term, this means building a sustainable enterprise franchise, serving the other top subnets in Bittensor (i.e., Templar), and allowing brilliant minds to train using Targon compute.

Conclusion

We are confident that by stitching together compute in an efficient manner, we will create the most attractive opportunity for mid-sized compute owners in the near term — and over the long run, for compute owners of all sizes. Together, we will have created a layer of compute that is both large enough and robust enough to compete with the leading labs. We understand the scale of our ambition and the intense focus it will take to get there. We are grateful for the continued support and encouragement of the Targon and larger Bittensor community.

© 2026 Manifold Labs, Inc.

All Rights Reserved